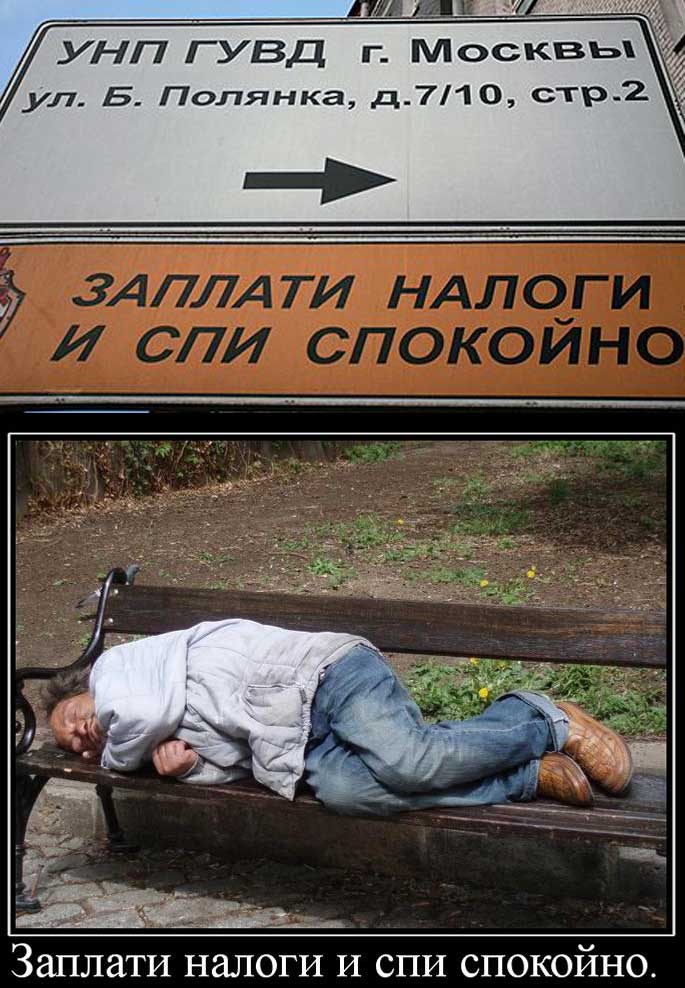

“Pay your taxes and sleep easy”

“Pay your taxes and sleep easy”

To cover holes in the budget, the Russian government is pondering the idea of reintroducing a progressive rate of income tax. And you can imagine the reaction…

Unofficial public reaction

The sensational statement came on 21 November from the lips of Deputy Prime Minister (“for society”) Olga Golodets, who declined, nevertheless, to say anything specific; only that low-paid Russians could be exempt from personal income tax.

Unsurprisingly, supporters of a progressive tax rate are few and far between: people are sure that the rich will avoid it, the poor will not benefit, and the middle class will bear the brunt.

Since 2001, Russians have paid personal income tax at the flat rate of 13%. But Alexander Auzan, dean of the Faculty of Economics at Moscow State University, is convinced that many people have no idea how much tax they actually pay: “In Russia, there are considerably more indirect taxes than direct ones. The average citizen in effect pays 48% of his real income to the state, but thinks he only pays 13%. He thinks that the state lives off oil and gas, and that he has nothing to do with it.”

In Auzan’s opinion, if citizens could decide for themselves what just 10% of their taxes were spent on (education or the Church, for instance), the idea of democracy would conquer hearts and minds. As it is, the idea to scrap personal income tax for the poor will likely lead to millions of people feeling like disenfranchised subjects dependent for everything upon the Kremlin. As a consequence, populist and paternalistic attitudes will become even more entrenched.

Experts are uncertain that liberating Russia’s poor from personal income tax can achieve its primary goal of improving their lives.Lilia Ovcharova, social research director at the Higher School of Economics, recalls that in 2015 almost 80% of the total rise in poverty was observed in families with children. The progressive tax rate should, therefore, take into account domestic circumstances and not, for example, penalise a father of many children with a salary of fifty thousand roubles, but a per capita family income at the subsistence level. Even if poor households are completely freed from personal income tax (in 2016, 15% of households were classified as such), it would not compensate for the drop in real incomes – at best the growth in poverty will be slowed by a third, calculates Ovcharova.

In order for poor households’ personal income tax to be shouldered entirely by the wealthiest 10% of Russian taxpayers, the rate applied to the latter needs to be upped to 25%. Given their renowned ability to tiptoe around the law, that seems unlikely. “Don’t think for one second that the fat cats will cough up,” says businessman and public figure Dmitry Potapenko. “Take Igor Sechin [of Rosneft], for instance, who earns five million roubles a day, yet that doesn’t mean that he will start paying tax. It only means that petrol prices will go up. The state will increase Sechin’s salary by whatever he pays in taxes, and the public will pick up the tab.”

According to Alexandra Suslina, a member of the Economic Expert Group, the budget will gain little from higher taxes on rich Russians,meaning that the hardships of progressive taxation will be likely to hit the middle class: “In reality, a progressive rate of personal income tax can only work by making the middle class pay more. Their standard of living will suffer, consumption will fall and some will slip into poverty, slowing down the already weak economic growth.”

Economist Sergei Aleksashenko puts his finger more precisely on who the “main victims” will be: “The rise in income tax will add pressure on the above-average-income strata of the Russian population – the ones who formed the backbone of the protests in 2011-12. In other words, the Bolotnaya-Sakharov opposition will have to pay more tax.”

Although the Ministry of Finance asserts that progressive taxation will not be on the agenda until at least 2018, the statement by Olga Golodets has been heard loud and clear on the Runet. Sergei Aleksashenko says that the increasing frequency of tax talk is no coincidence: people are being allowed to let off steam so that they gradually come round to the idea of the new tax rates.

Curiously, the online discussion of taxation is more balanced than for many other topics, with no one shifting responsibilityfor the progressive rate on to Russia’s usual enemies overseas:

Nikolai: “Turns out if you earn more than 15,000 roubles [a month] you’re rich!!!! That’s a whopping 229 dollars!!! Jeez, even I don’t know what to say about such lawmaking.”

Alexei: “The poor will become rich, and the rich poor. Officials will grow poorer. No doubt they’ve already prepared a report.”

Unsubscribed user: “Middle classes (people on 30-50,000 roubles), get ready to feed the poor while the bureaucrats and men in uniform grow fat.”

There is something else going on here. In established democracies, tax hikes cause greater public demand for government transparency and accountability. The Russian taxpayer, however, is minded differently; the main thing for him is to escape the attention of the state and forget about his contributions as quickly as possible.

The Russian public has been brainwashed into believing that the taxpayer exists only to hand over money to the state; and ask for nothing in return. A recent tax police campaign exhorted people to “Pay your taxes and sleep easy.” Anything more progressive than that, such as “How many roads and schools have been built with your money?” is unthinkable.

Or is it? What if the Kremlin were to stumble into a trap of its own making. Professor Auzan has penned a new slogan for that very eventuality: “Democracy begins with taxes – and doesn’t happen overnight.”